In this quick BTC guide we will show you the safest bitcoin exchanges to purchase BTCs and other coins from, as well as different purchase methods that you can use to make a profit from the trade. So, read carefully!

Summary: Buying Bitcoin at BTC Exchanges

- Choose one of the top 100 bitcoin exchanges that better fits your needs. The world’s most popular BTC exchange is Coinbase.

- Sign up and create an account.

- Be sure to read the terms of trade and make sure that you agree with them.

- Go to the page of buying bitcoins.

- Specify the number of BTCs you want to buy.

- Select your preferred payment method.

- Follow the instructions on the site until you get your BTCs.

What Fees Do I Need to Pay?

The greatest difference lays in payment options that each of exchanges offers to traders...

Popular Bitcoin Exchanges

There are many bitcoin exchanges that are both similar and different from each other...

Buy Bitcoins at Coinmama

Coinmama currently uses only credit/debit cards as a purchase method available for...

How to Get BTC on BitPanda?

This exchange platform services all of the Europe and offers a wide range of purchase methods...

Order Bitcoin at Bitstamp

Bitstamp offers various EUR and USD payment methods such as SEPA transfers, credit/debit cards...

Purchase BTC Through ZebPay

It is the first BTC exchange in India offering mobile platform as a trading ground for...

Since the beginning of the bitcoin trade in 2009, the global infrastructure of the crypto coin grew tremendously, with most of the countries being supported by various exchanges. Many of them turned out to be regular BTC providers with stable platforms and with good quality services.

This article will present you the top exchanges in the bitcoin market, listing their pros, cons, purchase limits and fees.

Bitcoin Exchanges: How to Choose?

Although the product is the same, these trusted exchanges vary in terms of how they provide their services and to whom. There are several factors that you should take into account when choosing your preferred bitcoin exchange:

- security of funds and BTC;

- fees;

- purchase limits;

- available purchase options;

- purchase process;

- verification requirements;

- regional coverage.

| Exchange | Deposit Fees | Countries | Buy Bitcoin | |

|---|---|---|---|---|

| Coinbase | 3.99% (credit/debit card), 1.49% (bank account) | USA, Canada, Australia, UK, Europe, Singapore | BUY NOW |

| Changelly | Higher than average (instant credit/debit card purchases, no ID verification required) | USA, Global | BUY NOW |

| Coinmama | 7.25% fee, minimum 10 USD (credit/debit card) | USA (22 states), Global At this moment, Coinmama exchange supports 40 U.S. states | BUY NOW |

| LocalBitcoins | 1% plus transaction fees | USA, Global | BUY NOW |

| BitPanda | 3-4% (credit/debit card), small surcharge (SEPA, EPS) | UK, Europe | BUY NOW |

| Coinhouse | 6-10% (credit/debit card) | UK, Europe | BUY NOW |

| Kraken | $5 (wire), free (SEPA) | USA (37 states), UK, Europe | BUY NOW |

| CEX.io | 3.5% + $0.25 (credit/debit card), $10 (bank transfer) | USA, Global | BUY NOW |

The best way to test an exchange is to cover all of the mentioned factors and see the reliability of the service.

Fees

Fees vary from exchange to exchange but the greatest difference lays in payment options that each of exchanges offers to traders. The cheapest purchase option is definitely bank account transfers, with fees ranging between completely free and up to 2%.

Cash purchases come either cheap (bank deposits) or very high (vouchers), with fees ranging between 1% and 12%. Credit/debit card purchases can go between 2% and 6% depending on the exchange while online payment options (PayPal, Skrill and Perfect Money) can be quite costly to use, going up to 10% of the transaction value.

Security

As with every other investment category, you want to keep your assets and money safe when dealing with bitcoin trading environment. Encryption, ledgers, hiring procedures, two-factor authentication and many other safety measures are important indicators of how secure an exchange is.

As the bitcoin infrastructure grew over the years, so did its community, with many websites listing scamming exchanges and experiences of other traders. Make sure the security measures are up to standards and that platform receives good reviews from other investors in a regular basis.

Trading & Currencies

If exchange offers a variety of cryptocurrencies and has large trading volumes month over a month, it is quite a good indicator of how efficient the business is. It shows trust by the bitcoin community and a competitive cost system that can suit your needs.

Most of the large volume platforms have close BTC value to the market average, while smaller exchanges tend to grow its exchange rate from the market standard.

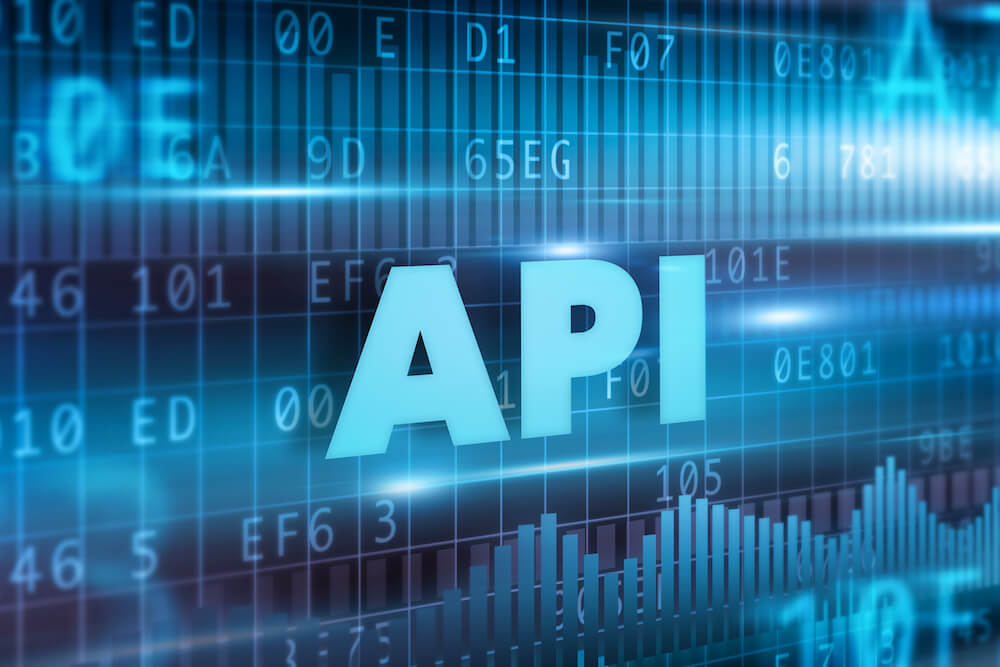

API

Application program interface (API) is an automated software interface tool that can automatically create complex trade orders for clients. Good, extensive API service is what makes an exchange a great one to work with. With such tool, traders can benefit from the highly value-fluctuating BTC currency not sitting in front of the computer for a whole day and let the API do the work for them instead.

Avoid Scam

What is the best way to avoid a scam? Make sure to work with only reputable exchanges that have great reviews in terms of their security, trustworthiness and stability of the service. Many exchanges that start out new the market, turned out to be scam sites that simply take the money from traders and disappear just as quickly.

Popular Bitcoin Exchanges

Since 2009, many exchanges succeeded in establishing themselves as leaders of the bitcoin market against other competitors. In this guide, we shall cover most reliable brokers and their services, fees, purchase limits, pros and cons, while the exchanges that shall be presented are: VirWox, Coinbase, CEX.io, Paxful, Coinmama, Wall of Coins, itBit, BitQuick, Coinhouse, BitPanda, Bitit, Gemini, Kraken, Bitstamp, Bitfinex, Unocoin, Coinsecure and Zebpay.

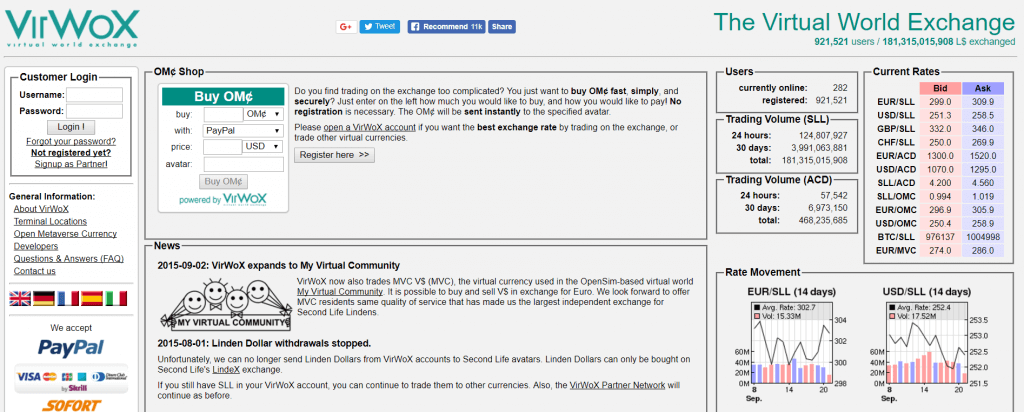

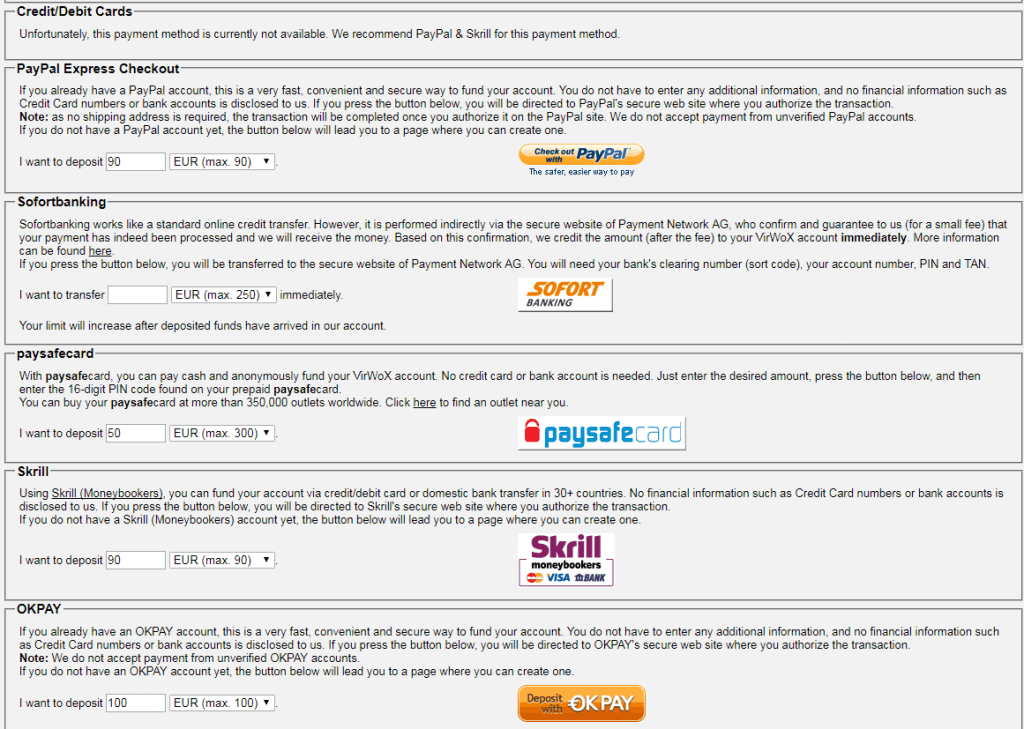

VirWox

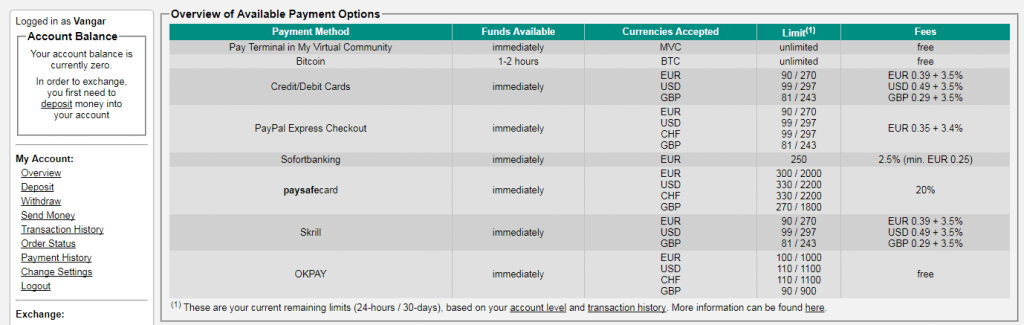

VirWox is primarily concerned with a virtual world called “Second Life” and the currency Second Life Lindens (SLLs) that are used on the said platform. Thus, it is not considered to be a strictly bitcoin exchange, since you cannot purchase BTC directly. The only way to get bitcoins is to purchase SLLs first and then trade them with BTC, incurring double fees in the process.

This exchange accepts a variety of payment options, including Skrill, credit/debit cards, bank transfers, OKPAY, SOFORT Banking, paysafecard and PayPal. The last option, PayPal is what made this broker so popular within the bitcoin community, as it is quite rare to find an exchange that sells BTC through PayPal payments.

Each of these deposit options have their own fee structure, which is organized as following:

- credit/debit cards and Skrill – $0.49 + 3.5%;

- PayPal – 0.35 EUR + 3.4%;

- sofortbanking – 2.5%;

- paysafecard – 20%;

- OKPAY – no fee.

The purchase limitations stand at approximately 400 USD daily and $4,000 monthly after 90 days since account registration.

Pros

- no verification needed to purchase bitcoins;

- buy limits depend on days since the registration of an account;

- variety of purchase options, PayPal included.

Cons

- double fees for bitcoin traders;

- bitcoin purchase process long and complex.

Coinbase

Coinbase is one of the largest exchanges in the bitcoin market, currently supporting 32 countries around the globe with the largest coverage located in Europe. The accepted payment methods vary across the countries, with SEPA transfer dedicated for European traders, PayPal for American investors while for everyone credit/debit cards & bank transfers are available.

The fees are considered to be the average of the industry, with credit/debit card and PayPal deposits standing at 3.99%, bank account transfers free, US bank transfers 1.49% and inner payments using the deposited funds standing at 1.49% as well.

Pros

- worldwide availability of services;

- three cryptocurrencies available: BTC, Ethereum and Litecoin.

Cons

- verification of the account is a must;

- three US states currently not supported (Wyoming, Hawaii, and Minnesota).

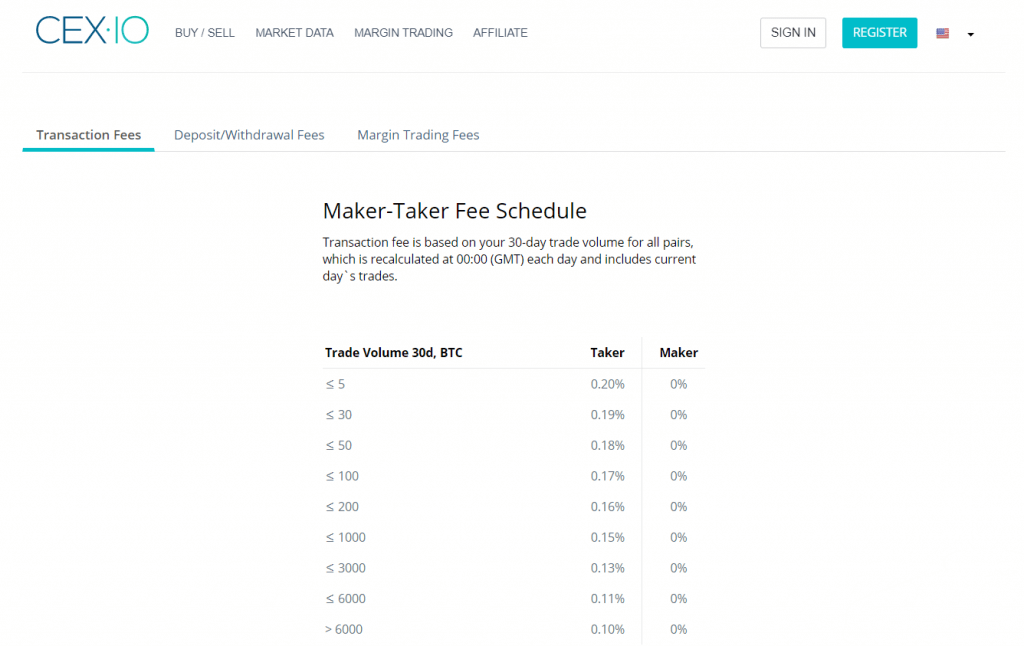

CEX.io

Since its start in 2013, this London-based exchange established itself as one of the top bitcoin and Ethereum businesses in the market, offering its services around the globe.

Currently, CEX.io is not supported in 28 US states as of yet while accepted purchase options are:

- credit/debit card purchase (3.5% + $0.25);

- SEPA transfer (free);

- bank transfers (free);

- online bank transfers (free).

Other costs include taker fees, which stands at between 0.2% and 0.1% depending on volume traded, while maker transactions are free.

You can purchase bitcoins without ID verification with small purchase limits of $300 daily and $1,000 monthly.

Pros

- anonymous purchases enabled for small BTC quantities;

- services are globally available.

Cons

- not available in 28 US states;

- verification process complex and long.

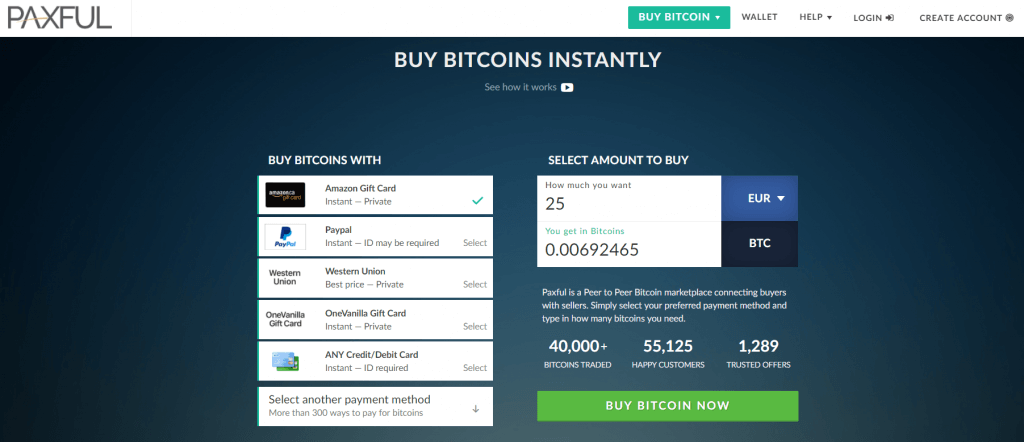

Paxful

Being a peer-to-peer (P2P) platform, the exchange offers a wide variety of purchase options for its traders. Paxful is available globally as the traders that work through the site can choose to buy and sell bitcoins between each other. The transaction fee stands at 1% no matter the purchase method chosen.

Additionally, the verification depends on the traders, thus it is quite possible to purchase bitcoins anonymously but beware of the scammers as they can abuse the private option to take your money and not deliver the coins to you.

Pros

- bitcoin purchases can be conducted completely privately;

- a wide range of purchase methods and fiat currencies, Western Union included;

- low 1% transaction fees;

- available globally.

Cons

- scams have been confirmed in the past;

- a small amount of bitcoins can be purchased from fellow traders.

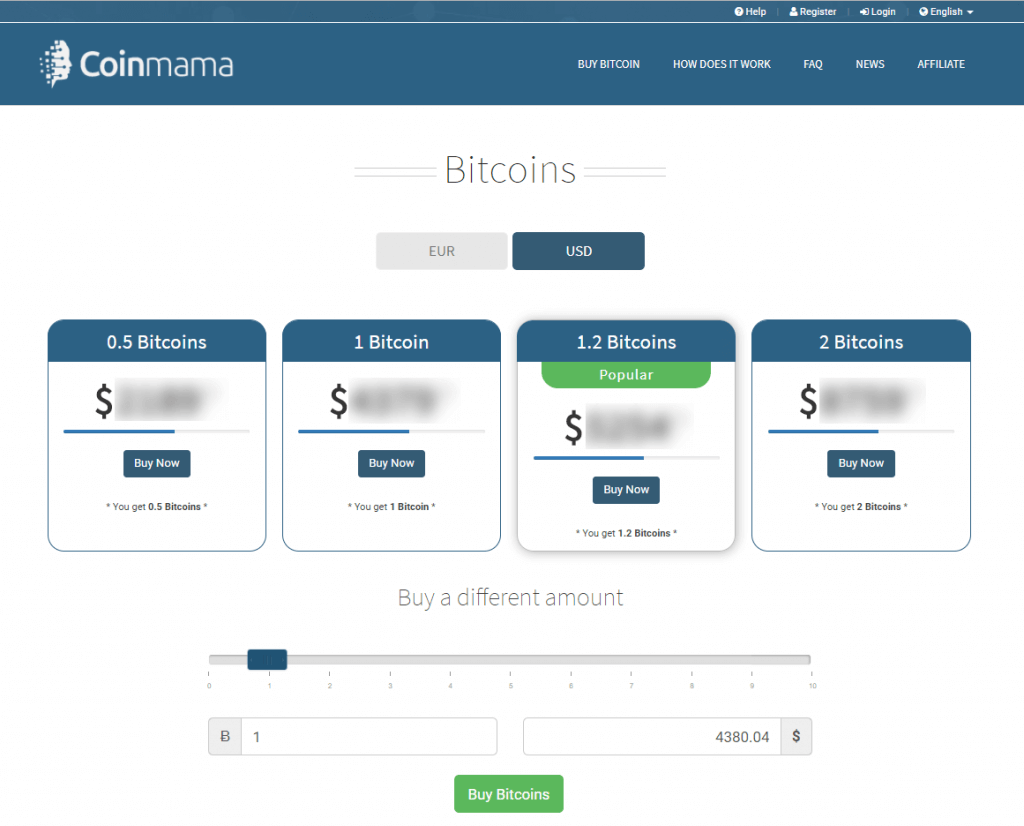

Coinmama

Coinmama is a MasterCard bitcoin exchange that currently uses only credit/debit cards as a purchase method available for bitcoin traders. Coinmama charges 6.3% of the transaction value while payment processor charges additional 5.65%.

The ID scan is required prior to the trade, thus you would need to undergo extensive verification process before you would be able to purchase bitcoins at Coinmama.

Pros

- high purchasing limits;

- globally available services.

Cons

- full verification needed to trade;

- purchase methods limited to only credit/debit cards.

Wall of Coins

Wall of Coins is a trustworthy P2P platform that supports fast cash purchases of bitcoins through bank deposits in 12 countries, US included. The traders would post the bitcoin ad and the bank where buyers can make the purchase at.

The fees are part of the BTC price seen on these ads while verification is needed only for your email and phone number.

Pros

- unlimited purchase limits;

- possible to purchase only $5 worth of BTC;

- no ID verification required.

Cons

- fees are part of the BTC price thus not transparent;

- limited regional coverage (12 countries only).

itBit

Licensed in New York, the itBit company offers two types of bitcoin trading, one being exchanged other OTC desk. The business operates in most of the countries in the world, US included (Texas not supported).

Additionally, the company accepts wire transfers only with full verification of the ID and address. The fees are one of the lowest in the market, with taker fees standing at 0.2% and maker activities being free of charge.

Pros

- service is globally available;

- one of the lowest fees in the market;

- OTC desk services offer large stacks of BTC.

Cons

- not available in Texas;

- full verification of ID and address required;

- only bank wire transfers accepted as payment method.

BitQuick

BitQuick is yet another exchange that only accepts cash deposits as it is specialized in quick sell and buys activities. The traders are required to undergo extensive verification process with fees being 2% to purchase BTC and 0% to sell. The platform works globally, with an exception of the New York state.

Pros

- instantly available bitcoins through cash deposits;

- globally available cash service in EUR and USD.

Cons

- full verification if a must;

- New York not supported.

Coinhouse

This French exchange allows traders to purchase bitcoins with credit cards and Neosurf cash options. The verification is mandatory and it involves an ID scan and proof of residence, alongside a selfie of you holding these documents.

At Coinhouse the fees are one of the highest in the market, with bank transfers costing between 10% and 6% and credit card between 10% and 8% depending on the trade value.

Pros

- globally available;

- 3D card purchase security.

Cons

- limited purchase options;

- full verification is mandatory;

- very high fees, ranging from 6% to 10%.

BitPanda

BitPanda is a European exchange platform that services all of the Europe and offers a wide range of purchase methods, such as:

- bank cards;

- bank transfers (wire, SOFORT, NETELLER and SEPA);

- Skrill;

- cash deposits.

Purchase limits depend on the verification stage completed while fees are not transparently shown but are rather part of the bitcoin price.

Pros

- a large amount of payment options;

- apart from BTC, the exchange also deals with ETH, DASH and LTC.

Cons

- USA is not covered;

- fees included in the BTC price.

Bitit

Bitit is similar with Coinhouse in many aspects, as it is French-based platform that accepts 3D credit/debit card and cash deposit purchases alongside with other options (CASHlib, MoneyGram, EPAY and much more). The cash deposits are done through vouchers that can be bought at licensed stores around the world.

The fees stand between 3.9% (bank cards) and 10% (cash deposits) and complete account verification is needed.

Pros

- available in more than 50 countries;

- many purchase methods offered.

Cons

- full ID and address verification required;

- high ash deposit fees of 8% and above.

Gemini

Gemini offers BTC and ETH to the traders located in the US (45 states), Japan, Hong Kong, Singapore, UK, Puerto Rico, Canada and South Korea. The trading fees stand at 0.25% while accepted purchase method is bank wire transfer expressed in USD.

The businesses behave more like a stock exchange than bitcoin broker as it is registered in the US as New York State limited liability trust.

Pros

- low transaction fees of 0.25%;

- established as limited liability Trust.

Cons

- 8 US states not supported currently;

- verification of your identity is needed.

Kraken

This exchange offers its services in Europe, USA, Canada and Japan; accepting local currencies if the served regions. The fees are organized in maker (up to 0.16%) and taker (up to 0.25%) costs and verification of your identity is required. The purchase/deposit methods that are accepted at Kraken are cash deposits and bank account transfers.

Pros

- a wide range of accepted fiat currencies;

- very high purchase limits after verification.

Cons

- verification of your ID is a must, proof of address is needed for higher purchase limit levels;

- somewhat limited regional coverage.

Bitstamp

Bitstamp is a very first EU licensed bitcoin exchange from Luxembourg that offers various EUR and USD payment methods:

- credit/debit cards (5% to 8% fees depending on volume traded);

- SEPA transfers (0.09 EUR);

- international wire (0.09%).

Apart from purchase options, Bitstamp also charges 0.25% trading fees for purchases of less than $20,000 of monthly value. Full verification is required to trade within Bitstamp with bank transfer.

Pros

- credit card purchases are private;

- services are globally available.

Cons

- verification needed for bank transfers;

- about 5 business days needed for bank transfers to be processed.

Bitfinex

Being trader oriented, Bitfinex exchange is not for the beginners in the bitcoin market, even if the exchange is widely popular due to its no verification policy and low fees (0.2% for takers and 0.1% for makers). On the other hand, the exchange has been hacked in the past, creating approximately $70 million loss for the business. Only SWIFT deposits are accepted.

Pros

- no verification needed to trade bitcoins;

- some of the lowest fees in the market.

Cons

- complex interface;

- has been hacked in the past.

Unocoin

Unocoin is the biggest Indian exchange that operates with over 150,000 traders on the daily basis. Its support, due to a large number of clients, has been criticized for slow response and lack of responsive action. The accepted payment methods are:

- INR wallet;

- PayU Money;

- online banking (NEFT/RTGS/IMPS).

The transaction fee stands at 1% and can fall down to 0.7% with sufficient volume traded and verification stage. Online banking incurs 1.9% transaction fee of the bitcoin trading value. Verification is required to be able to trade BTC while purchase limits depend on the stage of verification achieved.

Pros

- largest bitcoin source in India;

- low fees of 1%, going down to 0.7% with volume.

Cons

- verification is a must to trade;

- lack of effective customer support.

Coinsecure

As one of the major Indian exchanges, Coinsecure offers bitcoins at low transaction fee of 0.3% and the only country services is India, with domestic currency being the only fiat currency used. Traders are required to complete KYC (verification process) in order to buy and sell BTC within Coinsecure.

Accepted deposit methods are RTGS (Real Time Gross Settlement) /IMPS (Intermediary Payment System) / NEFT (National Electronic Fund Transfer).

Pros

- low transaction fees of 0.3%;

- unlimited purchase limitations after verification.

Cons

- services available only for Indian traders;

- full verification is a must.

ZebPay

ZebPay is the first bitcoin exchange in India offering mobile platform as a trading ground for BTC investors. The fees are not shown transparently, as they are part of the bitcoin purchase value while accepted payment methods are:

- RTGS;

- NEFT;

- IMPS;

- net banking.

Pros

- one of the best mobile platforms for BTC trade;

- additional services available, such as mobile airtime and gift vouchers.

Cons

- verification is required from traders;

- available on the mobile platform only;

- fees not shown transparently.

It also operates through mobile platform only, thus traders would need to download the app to be able to purchase bitcoins from ZebPay. Verification of the account is needed prior to the trading activities.

If you have any questions concerning bitcoin exchanges that have not been begoned in this guide, to contact us at BitcoinBestBuy site.