It’s easy to learn how to buy bitcoin with bank account because bank transfers are quite popular in the bitcoin market. This bitcoin guide will teach you the best ways to buy bitcoin, so keep reading. With Coinbase you can buy bitcoins with a bank account. Because we referred you, when you sign up and buy or sell $100 of bitcoin or more, you’ll earn $10 of free bitcoin!

Summary: Buying Bitcoin with Bank Account

Coinbase allows you buy bitcoin instantly with a bank account (ACH transfer) or credit/debit card. Here is a step-by-step guide to making the bitcoins buying process in the US as smooth as possible.

Using a Web Browser

- Proceed to Coinbase, it’s the most popular bitcoin exchange in the US.

- Complete the verification process (if needed).

- Go to the Buy/Sell page.

- Enter the BTC amount you want to buy.

- Select the wallet you wish to have your funds deposited into.

- Select your desired payment method (credit/debit card or bank account).

- Confirm the buy order is correct and click “Buy Bitcoin Instantly”.

- Your bitcoins will be delivered to your Coinbase BTC wallet immediately.

- Transfer them to your hardware bitcoin wallet to securely store your bitcoin for the long term (optional).

Using the iOS & Android Apps

- Create a Coinbase account and download iOS or Android app.

- Tap the menu icon near the top left of the screen to open the Navbar.

- Select Buy from the Navbar.

- Enter the amount in bitcoins (BTC) that you wish to buy.

- Select the bitcoin wallet you want to deposit into.

- Select your preferred payment method (credit/debit card or bank account).

- Review your order and tap Buy bitcoin.

Please note:

Coinbase supports Instant Buy feature using U.S. bank account. When you fully complete identity verification and build a history of successful purchases, you will receive higher bitcoin buy and sell limits.

How to Buy BTC with Bank Account at BitPanda

If you want to buy bitcoins in EUR then you should get acquainted with European exchange...

Order Bitcoin on CEX.io Service

This is an exchange offers its services globally through wire transfers, ACH and SEPA...

Get BTC at Safello Exchange

Swedish broker offers bank transfer options such as...

Review Xapo Exchange & Wallet

Another interesting exchange that started as vault service provider and only recently...

Get BTC with Bank Account Without Verification

Most of the exchanges offer bitcoins without verification would limit your purchases...

Bitcoins with a Bank Account in Different Countries

If you are a resident of America ACH transfers are what you should look...

Apart from credit cards and PayPal accounts, you can also purchase bitcoins from exchanges by using bank account transfers as well. Even more so, it is a secure way to send and receive funds for bitcoins, favored by both traders and brokers.

The reason is simple – the banks charge exchanges low fees for the transaction to happen while the funds would reach its destination without any issues. This article will show you which exchanges accept the bank account method and how do they differ in terms of bank transfer payment.

Bitcoin Exchanges List

Due to its popularity, there are quite a few exchanges that are accepting bank transfers and bank account payments. They differ in terms of regional coverage, fees, fiat currencies accepted as well as the verification requirements for traders.

This guide will present you the top 24 places where you can buy bitcoins instantly with a bank account. We shall also provide you with insight knowledge of how the trade works and what you should know before you choose an exchange.

BitPanda

BitPanda is a European exchange that offers bitcoins through bank transfers expressed in EUR only. The accepted bank account payments are: SEPA, SOFORT and online bank transfer.

The limitations depend on the verification level achieved and it is possible to purchase BTC with only phone and email verified (€50 purchase limit daily).

Pros

- possible to purchase bitcoins anonymously;

- a wide range of bank transfer payment methods.

Cons

- fees are hidden in BTC price;

- ID verification required for higher buy limits.

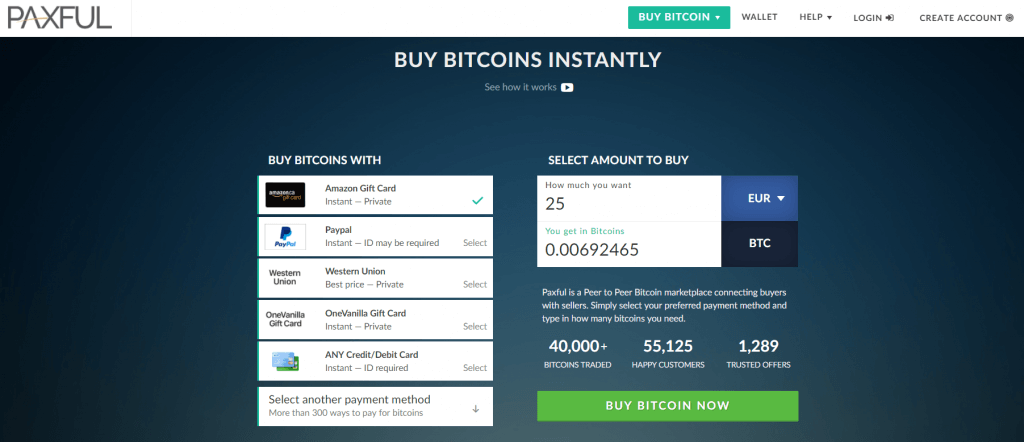

Paxful

Being a peer-to-peer (P2P) platform, Paxful offers a huge range of bank account transfers for traders to use when buying bitcoins in the market.

The platform offers a chance for investors to buy and sell BTC among themselves for a transaction fee of 1%. It is up to the individual to decide what verification level he wishes to achieve.

Pros

- completely anonymous purchases allowed;

- a low transaction fee of 1%;

- variety of bank transfer options.

Cons

- high possibility of scams;

- usually the only small amount of coins available.

Coinbase Exchange

Coinbase offers a variety of bank account transfers for its clients, depending on their locations. US traders can use bank transfers for a fee of 1.49% while European customers can use SEPA transfers for free.

Pros

- large purchase limits;

- low or no fees.

Cons

- requires full verification of your identity;

- bank transfers can take up to 1-2 business days in Europe and the UK (SEPA), 3-5 days for wire transfers, instant with US bank account (ACH transfer).

LocalBitcoins

Being one of the biggest P2P bitcoin marketplaces, LocalBitcoins offers a large platform where traders offer a huge range of bank account transfers and deposits for investors to buy bitcoins with them.

The transaction fee stands at 1% of the trade value and is quite possible to purchase bitcoins with no verification.

Pros

- can buy BTC with no ID verification;

- globally available;

- large choice of BTC offers.

Cons

- scams have been reported in the past;

- mostly small amount of bitcoins offered.

Kraken

With fees ranging from 0.1% to 0.25%, this European exchange offers bitcoins to traders from America, Japan and Europe. At Kraken there are available bank transfer methods like international bank transfer, SEPA transfer, and Interac while verification of your identity is a must.

Pros

- low transaction fees;

- high purchase limits ($2.500 daily).

Cons

- ID verification required;

- somewhat limited regional coverage.

LibertyX Exchange

LibertyX uses a network of ATM machines and stores to sell bitcoins to its clients. This American-based exchange accepts bank account payments though be advised that stores control the fees and verification requirements.

The platform is available for mobile users only and provides a detailed map of the stores near you.

Pros

- a wide range of US banks collaborating with LibertyX;

- possibility to purchase bitcoins with no ID.

Cons

- service available only in America;

- some of the stores charge high fees.

CEX.io Bitcoin Service

CEX.io is an exchange that offers its services globally through wire transfers, SEPA and ACH bank account deposits. With a fee of 0.2% for bank account payments, CEX.io offers very high purchase limits after complete verification is completed ($10,000 daily and $100,000 monthly).

Pros

- services globally available;

- low 0.2% trading fees.

Cons

- complete verification of identity is needed;

- bank transfers can take up to a week to be processed.

BTC-Broker Coinfinity

Based in Europe, Coinfinity exchange offers instant access through SOFORT bank account deposits. The services are available only in Austria with fiat currency accepted being EUR. Full verification of your identity is needed.

Pros

- instant access to coins;

- deposits free of charge.

Cons

- very limited regional service availability;

- full verification is a must.

BTC Platform Bitfinex

One of the most popular exchanges in the US is Bitfinex, as it offers a large amount of bitcoins for purchase without any sort of verification required from the clients. Fees stand between 0.1% and 0.2% depending on the trading volume.

Pros

- USD transactions are verification-free;

- very low trading fees of 0.2% to 0.1%.

Cons

- has been hacked in the past;

- EUR transactions require verification.

Cubits Service

Cubits offer SWIFT, SOFORT and SEPA transfers for traders around the globe with an exception of the US. The transaction fees stand at 0.9% while verification is required from traders in order to purchase bitcoins.

Pros

- variety of bank transfer methods;

- various fiat currencies supported.

Cons

- US not serviceable;

- verification is required for BTC purchasing.

Bitstamp

The Bitstamp exchange is growing in popularity in the last few years, as the transaction fees are some of the lowest in the market, ranging from 0.25% to 0.1% depending on the volume. SEPA and wire transfers are accepted with full verification of your identity.

Pros

- low transaction fees between 0.25% and 0.1%;

- globally available services.

Cons

- has been hacked in the past;

- ID verification is required fromtraders.

Bity Exchange

Bity exchange is a European broker that offers BTC for a transaction fee of 1%. The accepted payment methods are SEPA, SOFORT and OBT and limitations depend on the verification level achieved (daily limit of $1,000 and $4,000 yearly for phone verification).

Pros

- possibility to purchase bitcoins without your identity check;

- variety of bank transfer options available.

Cons

- available only for European investors;

- verification needed for higher buying limits.

Safello Service

Based in Sweden, Safello offers bank transfer options such as Bankgirot, SEPA and International Bank Transfer, with each country having a specified method of bitcoin purchase.

Pros

- a wide range of bank account payment methods;

- bank transfers up to three business days.

Cons

- only 32 countries available (mostly Europe);

- fees part of the BTC value;

- ID scan is a must operate with bitcoins.

CoinCorner Bitcoin Exchange

The UK-based exchange, CoinCorner offers bitcoins through SEPA bank transfers expressed in either GBP or EUR fiat currencies. The transaction fees stand at 1% and verification of your account is a must-do to be able to trade with bitcoins.

Pros

- small private BTC purchases available;

- transactions are done up to two business days.

Cons

- account confirmation (ID and proof of address) required;

- USD payments not available.

Wall of Coins

Another P2P marketplace that offers bank transfers as a payment method for bitcoins. At Wall of Coins the transaction fees stand between 1% and 2% and are not separately displayed from the bitcoin price. You need to verify only your phone number to be able to purchase bitcoins.

Pros

- no ID verification needed;

- no purchase limits.

Cons

- online bank transfers not available;

- fees not transparent – included in price;

- limited regional coverage.

GDAX Exchange

Created by Coinbase, GDAX has double bitcoin sourcing, as it depends on its own supply of coins, as well as Coinbase’s. It regional coverage is the same as with Coinbase, while fees for bank transfers stand between 0.25% and 0.1%. Accepted bank transfers are SEPA, ACH and wire transfers.

Pros

- two sources of bitcoins;

- very low trading fees.

Cons

- verification of your account with scanned ID a must;

- limited global coverage.

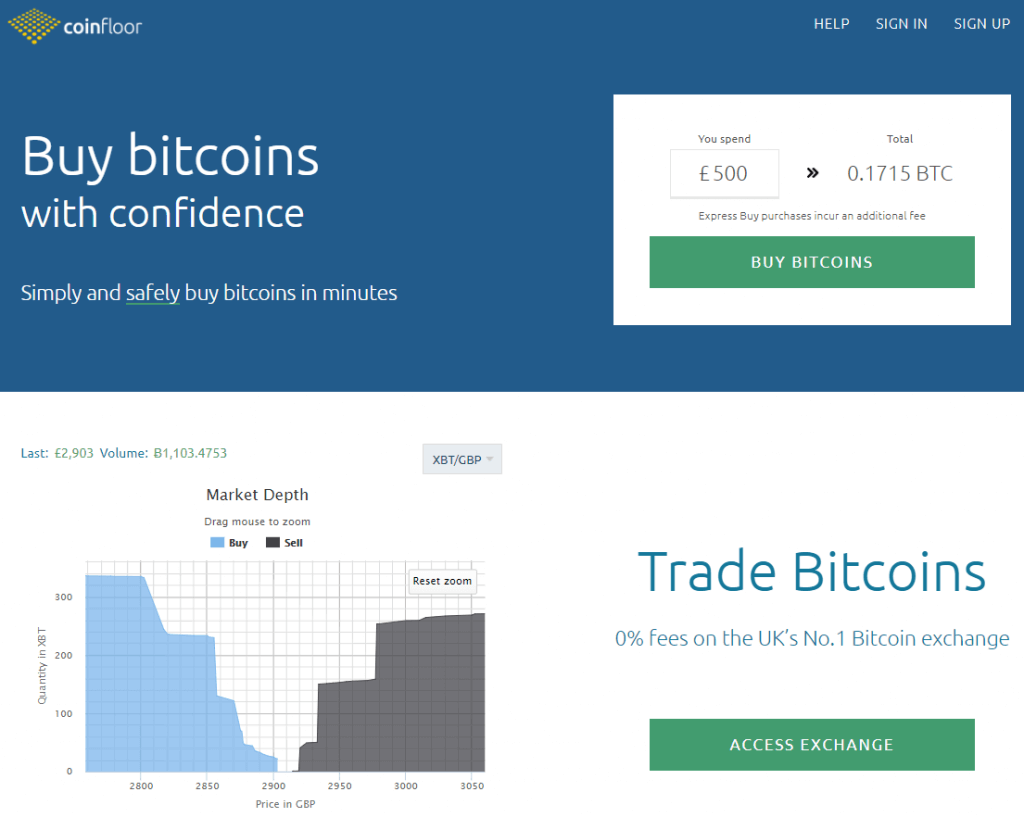

Coinfloor

Coinfloor offers its services to the UK’s and European traders only through SEPA bank transfers for a transaction fee of between 0.34% and 0.38%. The cost level depends on volume traded on a monthly basis while minimum deposit amount stands at 1,000 units of either GBP or EUR.

Pros

- low transfer fees between 0.34% and 0.38%;

- high purchase limits after verification.

Cons

- full verification required – ID and proof of address;

- limited regional service coverage;

- high minimum deposit amount of €1,000.

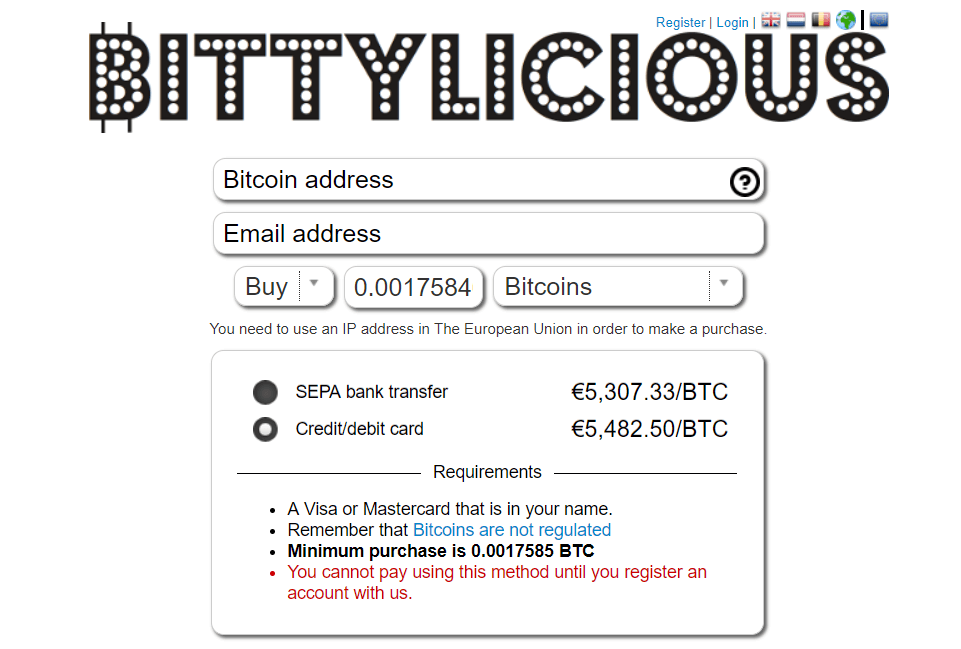

Bittylicious Service

Bittylicious is very similar to Coinfloor, as it is also the UK exchange. One major difference lies in the fact that broker operates in the UK only and you have a possibility to purchase small amounts of bitcoins privately.

Pros

- small purchases do not require ID scan;

- connected with numerous web and local wallets.

Cons

- the only UK supported currently;

- higher purchase limits require verification.

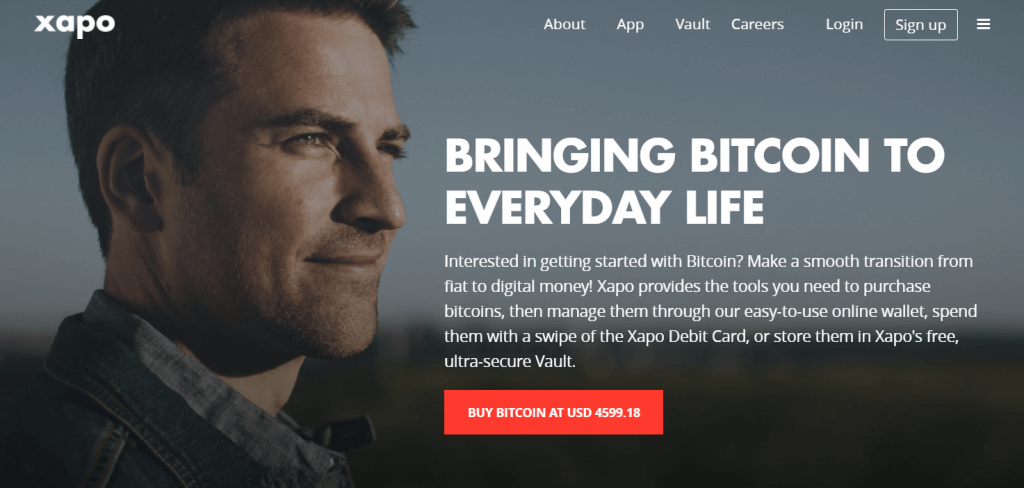

Xapo Bitcoin Exchange & Wallet

Xapo is an interesting exchange as it started as vault service provider and only recently has added exchange services as well. The bitcoin purchase and stashing service become available after full verification of your identity, while bank transfers are carried out for free.

Since you get a Xapo debit card, bank transfers are conducted fairly fast.

Pros

- no purchase limitations;

- Xapo debit card available;

- globally available;

- transactions are done free with sufficient volume.

Cons

- you would need to verify your ID;

- wire transfers might take more than a week to be processed.

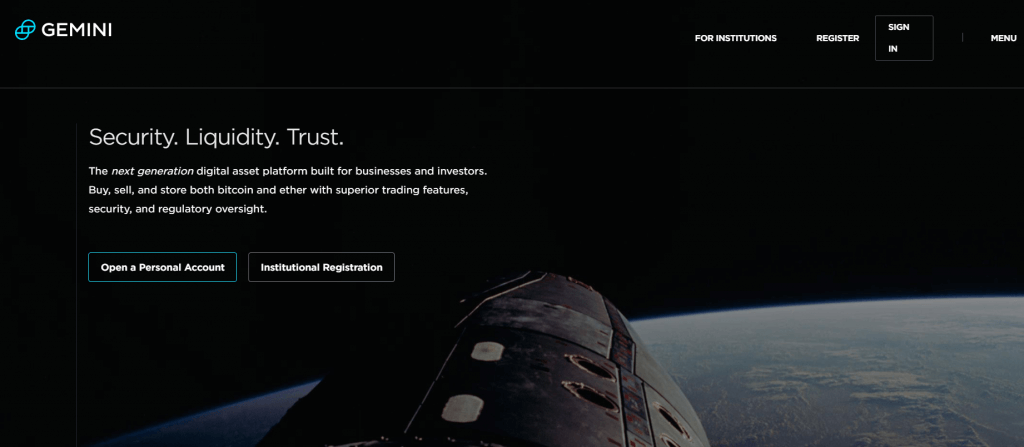

Gemini Bitcoin Service

Gemini offers its services in the US (42 States), the UK, Singapore, Hong Kong, South Korea and Japan through ACH and wire transfers. The fees range between 0.15% and 0.25% depending on the BTC volume level achieved and verification is a must.

Pros

- low transaction fees of up to 0.25%;

- good BTC and USD liquidity.

Cons

- verification needed to purchase BTC;

- a small number of countries serviced.

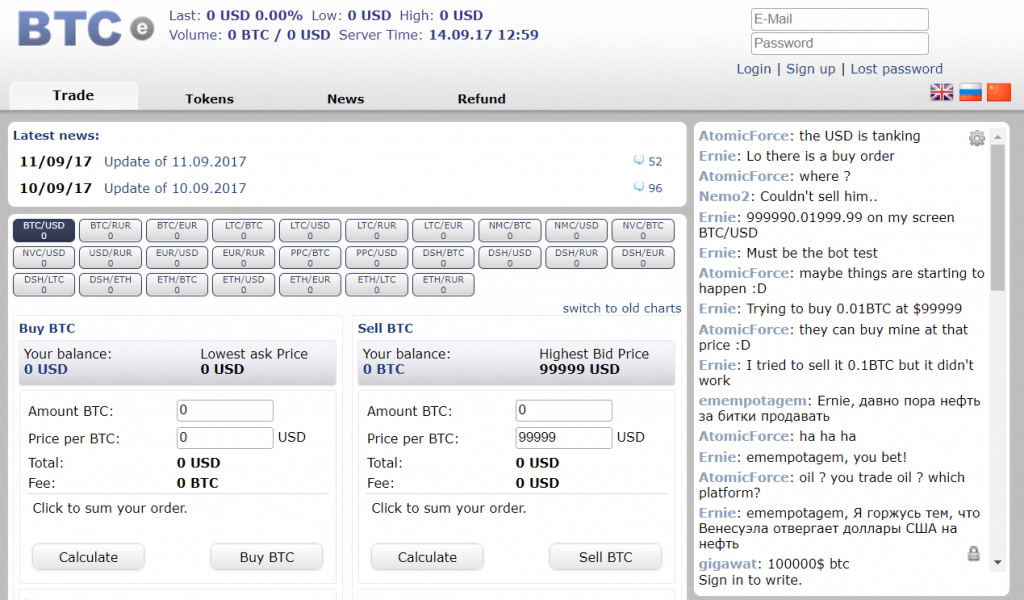

BTC-E

BTC-E was a P2P platform that operated globally as other peer-to-peer platforms like LocalBitcoins and Paxful. Unfortunately, the domain of the exchange has been seized by US Department of Justice and is under investigation.

BTC Bank Paymium

Based in France, Paymium offers its services only to European clients with SEPA transfer being the main purchase method for the traders. The purchase limits depend on verification level achieved.

Traders can purchase up to 100 EUR daily without ID verification while with scanned ID, the limit would increase to 2.500 EUR.

Pros

- low trade fee of 0.59%;

- possible to purchase bitcoins privately.

Cons

- available only in Europe;

- verification needed for higher buy limits.

HappyCoins

HappyCoins is another European bitcoin provider that offers cryptocurrency for traders that have a European bank account. The accepted transfer methods are iDEAL, GiroPay, MyBank, SOFORT, and SEPA and they vary in terms of days needed to process the funds (from 1 to 7 days). Fees are part of the bitcoin price.

Pros

- a wide range of bank transfer options;

- ability to purchase bitcoins within 24 hours.

Cons

- verification is needed for bitcoin trade;

- services limited on European bank accounts only;

- fees not shown transparently.

Bitcoin ATMs

If you are looking for a way to instantly purchase bitcoins while keeping privacy, ATM machines would be a good choice for you. Equipped with sophisticated software, the ATM machines provide bitcoins fast and privately though at a cost as most of them have fees ranging from 8% and above. All you have to do is to head over to the nearest ATM from you, provide bank account details and commence the trade.

Pros

- one of the fastest ways to purchase bitcoins;

- completely anonymous.

Cons

- possibility that ATMs are not near your location;

- service might not always be available.

Get BTC with Bank Account Without Verification (No ID)

There are several ways to purchase bitcoins without an ID from your side. Most of the exchanges offer bitcoins without verification would limit your purchases, so you can trade with many of them at the same time to bypass the transaction limits.

Another way is to buy bitcoins from traders that do not require ID at P2P platforms, such as LocalBitcoins and Paxful. Lastly, you can always head over to the nearest ATM machine and buy BTC there.

What Exchange Should I Choose?

The best exchange for you is not necessarily the best for others, as they vary in many things. The exchange that would suit your needs the most is the one you should trade with. Make sure you check if they offer you a payment method that is suitable for you, serve your location and have good security to protect you from scams.

Fiat currencies are also important, so make sure they use the same one as you do. Lastly, you do not need to choose only one broker for BTC trade. We would recommend you to work with few of them as to spread your coins around and have a greater foothold in the market.

Buy Bitcoins with a Bank Account in Different Countries

If you happen to live in America, ACH transfers are what you should look for while SEPA transfers would suit only European traders. Many exchanges offer both types of bank account transfers but make sure to check our review (and their websites as well) to see which exchange offers its services in your region.

Should you have any question regarding bank account payments that have not been covered by this guide, feel free to contact us at BitcoinBestBuy.