In recent years, bitcoin becomes an object everyone heard about. Still, not every person know what it really is. Therefore, if you have questions — go ahead and read our article, because in this quick guide we’ve gathered all essential knowledge to vanish your uncertainty regarding bitcoin.

Summary: How to Buy Bitcoins

- Register an account at the exchange of your choice (in our case, Coinbase).

- Verify your email, phone number and identity though scanned ID and proof of address.

- Once verified, click “Buy/Sell” button and fill out the purchase form.

- Check the details and click “Buy Bitcoin”.

- Choose the preferred payment method and provide details regarding either credit card or bank account.

- Check all details and click “Buy” to end the process.

- Withdraw bitcoins to your external wallet address, with the most secure stashing product being bitcoin hardware (HD) wallets.

Short History of BTC

The history of BTC begins in 2009, some man or group of them created bitcoin as a new...

Know More About Blockchain

While talking about bitcoins, it is necessary to understand whole blockchain...

Questions and Answers About Bitcoin

This part regards the FAQ and will tell fundamental information about bitcoins in simple...

Wallets

Bitcoin wallets are platforms where bitcoins can be stored, and are used when you need...

If Bitcoin Will Fail

Bitcoin depends on the market and people, who support it. If only it loses endorsement...

Advantages of Bitocoins

Bitcoin has many benefits, and the most substantial of them is decentralization...

Getting started, in this guide, we aim to provide detailed explanation on what bitcoin is all about, its current situation and what future holds. We also go through technical specs of the cryptocurrency and how does it influence altcoins. Lastly, we provide interesting facts and benefits that investors get from bitcoin.

What Is Bitcoin?

So, what is bitcoin? Putting it down in simple terms, the definition goes like this: bitcoin is a digital currency, existing only on internet. It can be considered as a file that is created and transferred around using computers, which are seen as bitcoin nodes. It is not governed by a single entity nor is an institution responsible for its value. It is completely decentralized asset that is moved by the market and peers inside it.

Its value is not singular either, as its price depends on its holder and strategy used. It means that you can purchase and sell the currency at different price at any point of the day. It is available for everyone and is not restricted towards one region or group of people. You need a bitcoin wallet in order to hold and transfer BTC around.

BTC Short History

The BTC’s history begins in 2009, certain person or group of them created bitcoin as an alternative to fiat currencies. The abovementioned entity called itself Satoshi Nakamoto, whose identity is yet to be revealed. The blockchain technology, first wallet and other services have been developed simultaneously, as well as mining supply already set to be reaped by interested parties.

Since that period, bitcoin grew its own network of exchanges and online businesses accepting the currency. In 2011, other currencies started to be developed, with first ones being Ethereum, Litecoin and others. In 2012, a Bitcoin Foundation was created to speed up the process of integrating the coin into the daily lives of ordinary people around the globe.

Several platforms and business started accepting BTC as means of payment in 2013, with most prominent of them being University of Nicosia, Overstock.com, Silk Road, Baidu and many more. In 2017, first hard fork emerged that resulted in Bitcoin Cash being developed. Since that period, bitcoin grew tremendously in value, pushing its fame and price towards what we see today.

Who Controls Bitcoin?

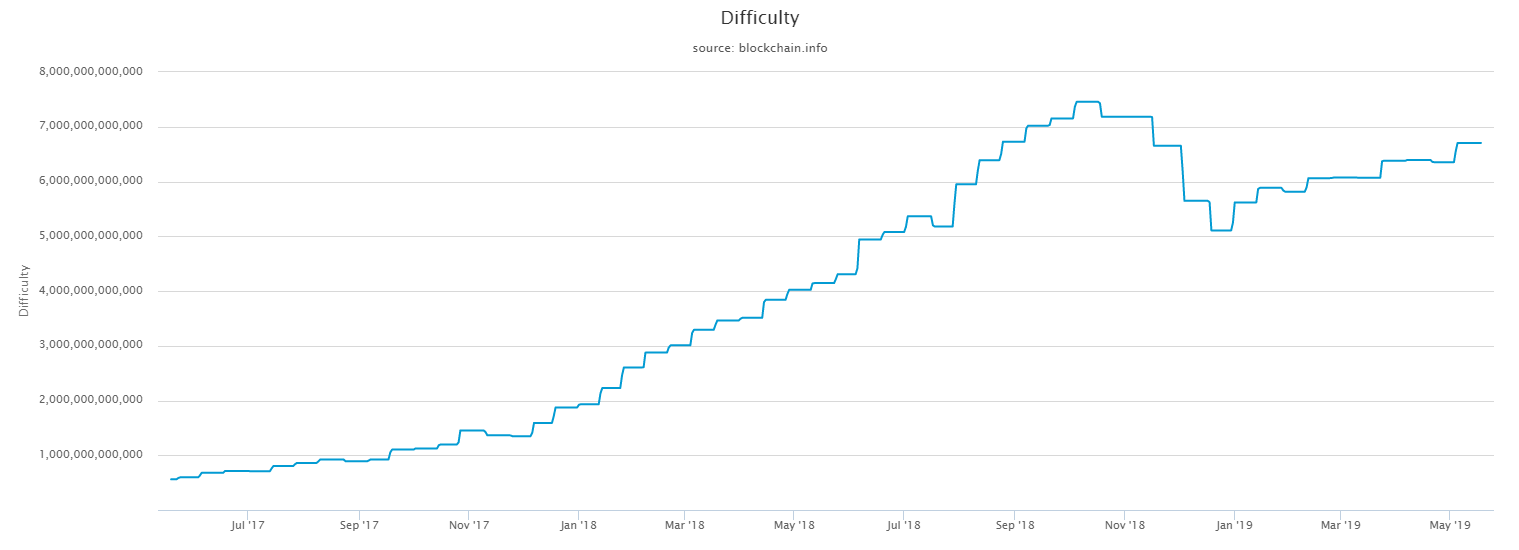

Since its beginning, bitcoin poised itself as completely decentralized blockchain technology that no one really controls. It is driven by the market and everyone has a small amount of rights and control by buying, selling and mining it. Nowadays though, situation changed a bit due to its popularity. Large companies started their mining farms, driving mining difficulty higher.

Ordinary people find it harder and harder understating bitcoin mining, thus leaving the supply to handful of large players in the market. It is still not controlled by a single entity and its trade revolves around millions of people but it is not as decentralized as it used to be at its beginnings.

What Is Blockchain?

When talking about bitcoins, it is inevitable to understand blockchain technology as well. Blockchain is a system of transaction bookkeeping , where all cryptocurrency activities are recorded. This adds security to the market, as addresses doing the transfers are listed out, volume of coins sent & received written for general public to inspect and make analysis of.

Bitcoin implements its own blockchain, meaning that you can trace yours and other’s activities back since the introduction of the coin. It is managed by peer-to-peer (P2P) network as it is ledger for both mining and trade transactions.

What Is Bitcoin Farming and Mining?

Bitcoin is based on Proof of Work (PoW) algorithm, which is a computer language used to make complex calculations. Computers solving these calculations are awarded tokens as a result of their efforts, with the activity commonly known as mining. Miners get batches of BTC (abbreviation of bitcoin) through constant mining.

These batches are called order blocks and awarded through sufficient hash power and certain dose of luck. Network itself chooses among various miners who get these blocks based on its own mathematical calculations. Miners also get bonus volumes from fees that traders pay when transferring coins around as well.

Truth be told, batches halve after certain amount of time and difficulty of mining has been on the rise since the beginning of the bitcoin, making it more difficult to successfully farm the cryptocurrency.

How Does Bitcoin Work – Technical Explanation

To start off with technical explanation, bitcoins need to be mined in order to supply the market. Miners establish their “farms” through purchase of specialized graphics cards with high hash power. Once awarded, miners get these blocks into their wallets and then transfer them to exchange markets to be sold of using either fiat money like USD or EUR or through altcoins (Litecoin, Ethereum, DASH, etc.).

While transferring coins around from wallets to exchanges, network needs to provide several confirmations, as to secure transactions and avoid hacking attempts. That is why it takes time for supply to reach the market, as these confirmations can take form 10 minutes to a whole day, depending on the chosen speed. All of these activities are recorded in the blockchain ledger books which can then be inspected at any point of time.

Bitcoin Future or How High Could Bitcoin Go?

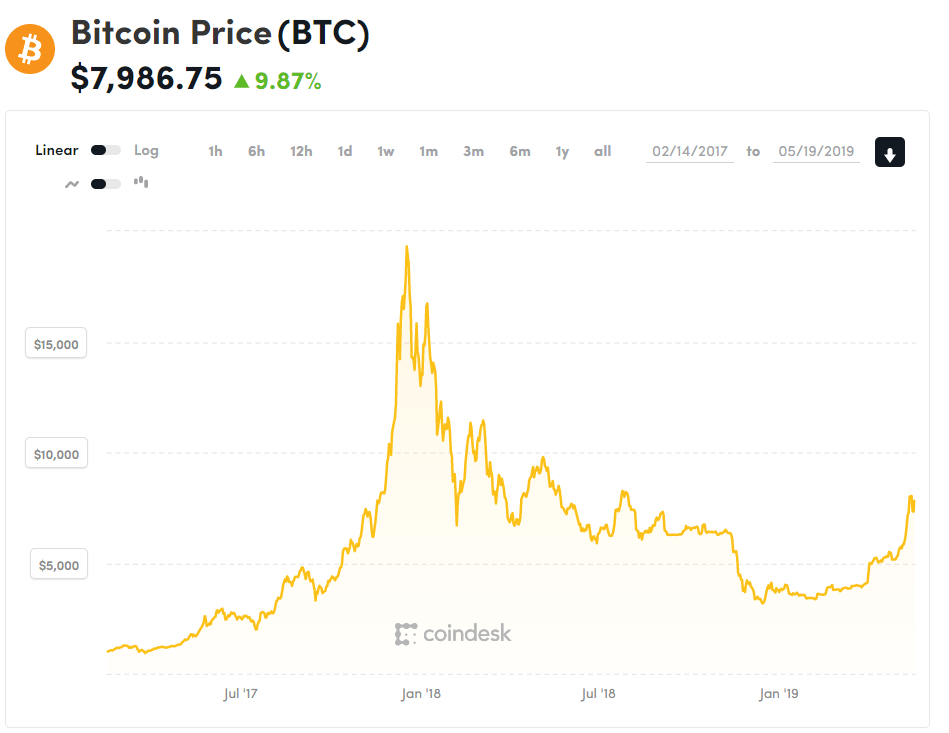

At the beginning of 2018, many believed that bitcoin’s price will soar even more. Some of the predictions saw BTC reaching a million USD per coin. However, the current situation is quite different. After the initial breakthrough of $20.000, the crypto experienced a major bear push. Throughout 2018, the price constantly kept falling, finally stabilizing near the end of the year. You can check out price movement in the analysis chart below from CoinDesk.

At the same time, as the price decreased, the mining difficulty, paradoxically, increased as well, rendering GPU/CPU mining equipment useless. Nvidia suffered major sales losses as a result while the supply of the crypto became somewhat centralized. Only major pools and companies can mine bitcoin efficiently and profitably right now. However, in 2019, the overall hash difficulty finally relented, dropping down to the mid-2018 level.

Bitcoin future value predictions are hard to make. Bear movement seems to have taken hold of the market. However, many called 2018 a year of development, whereas 2019 will be a year of adoption. Bakkt, Nasdaq, and ETFs have the power to propel the price forward.

Today, it is easier than ever to purchase bitcoins with cash or credit card, making the crypto quite a liquid asset to hold. Its value is bound to change with all levels still on the table. However, whether it will reach a million in a year, two or a decade is still very much impossible to predict.

Bitcoin FAQ

This section regards the FAQ that will answer basics of bitcoins in terms of its volume, creation and other relevant information regarding the cryptocurrency. It is aimed to help you learn more on exactly what bitcoin is.

How Many Bitcoins Are There?

We need to differentiate the total volume of coins from volume in circulation. The latter are bitcoins that can be found in exchanges and wallets, already mined and stashed by individuals and organizations. The circulating number of coins stands at 16.9 million BTCs, currently worth of approximately $136 billion. The volume expressed here constitutes wallet form held by both traders and exchanges from around the globe.

As for the total supply, there is a maximum amount of 21 million coins, meaning that the rest of 4.1 million coins (approx. $168 billion) is available for mining in due time. It is important to note that it will never reach full cap as to control inflation.

Who Created Bitcoin?

As mentioned before, an individual (or group of them) called Satoshi Nakamoto developed the blockchain technology, token and its wallet in 2008. Little is known about him (them) and the real identity is yet to be revealed although many speculations exists nowadays.

Is Bitcoin a Ponzi Scheme and Scam?

BTC system is definitely not a Ponzi scheme, despite what financial institutions and some people might want you to believe. It is a legitimate cryptocurrency system, which can be received, sent and minded.

All transactions are recorded in the blockchain’s ledger records, making transfers traceable since the start of bitcoin.

What Are Wallets?

Wallets are online platforms where you can stash and transfer to or from bitcoins and other cryptocurrencies. These storage capacities have coding and programs that allow it to send and receive BTCs using the blockchain network. There are several types of wallets that you should know about, with overall distinction serrated into hot and cold storage wallets.

Hot wallets are used when speed is needed and fees are usually cheap. Cold storage is tougher to use and understand but provide a lot more security for its users.

Will Bitcoin Fail?

The success or failure of bitcoin depends on the market and people backing it up. If it loses support from investors ad enthusiasts, it will definitely fail. However, we are witnesses to its unprecedented market growth, with many large players entering the fame (such as Microsoft). Thus, we believe that bitcoin is here to stay for good.

Is Bitcoin Anonymous?

Blockchain records do not hold any personal information, leaving the market to monitor itself. You can trade bitcoins anonymously at some platforms while there are exchanges (especially big ones) that would require you to provide personal documents.

It all depends on whom you are working with, but BTC does strive to be a private network.

What Is a Hash?

Hash, otherwise known as hash power as well, is an algorithm that turns large amounts of information into smaller data batches. Bitcoin uses the SHA-256 hash algorithm to verify data using the CPU equipment. The hash power refers to the ability of the algorithm to work with large batches of data, meaning more power – more data analyzed and verified.

Why Does Bitcoin Fluctuate?

Since BTC is not controlled by a single entity and each single holder has the right to set his or her own pricing policies, the coin fluctuates according to the market trends.

If supply grows, price goes down and vice versa. You also have mining difficulty thrown into the equation, since its rate is rising as well. The more difficult it gets to be awarded, its price would naturally go up to cover mining costs.

How Many Bitcoin Users Worldwide?

There are no exact statistics on BTC users, since many are passive, holding the coin for later use. What we can safely say is that their number is measured in millions at this point, with many of them actively trading and farming on daily basis.

How Bitcoin Is Related to Other Cryptocurrencies?

Bitcoin is a pioneer of the crypto world, driving many developer teams to make other coins as well. Ethereum, Litecoin, DASH, Zcash and all others have been created as an influence from BTC.

Even today, bitcoin reigns supreme, holding most of the industry’s value. It is still so large that shifts in its value impact other currencies directly.

Interesting Facts About Bitcoin

Here are some fun facts for you to know about bitcoin:

- the first ever purchase using bitcoins was for pizza;

- 21 million coins is a supply that shall never change;

- there are no tools available that can “ban” bitcoin;

- using bitcoin paper wallet tied on weather balloon, company called Genesis Mining sent bitcoins into the space;

- FBI probably holds the largest bitcoin wallets;

- many new money-laundering schemes involve bitcoins.

Benefits of Bitcoins

Bitcoin holds many benefits and advantages, with the most important of them being:

- blockchain records offer complete transparency of the market;

- decentralization of the crypto provides power to all participants of the industry;

- complete control over your assets;

- possibility to earn profit from trading at different platforms;

- can be mined;

- high security as all transactions are traceable;

- possibility for complete privacy when doing transactions with bitcoin;

- bypasses complicating money transfer procedures and high banking fees.

Should you have any questions regarding this bitcoin review, do not hesitate to contact us directly at BitcoinBestBuy, since we will come back to you with required answers.